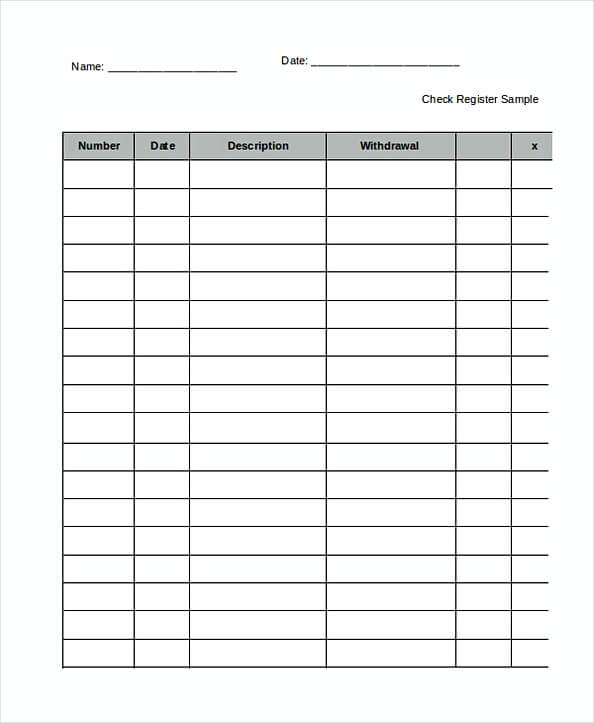

40+ Free Download Printable Check Register Template for Your Business Report

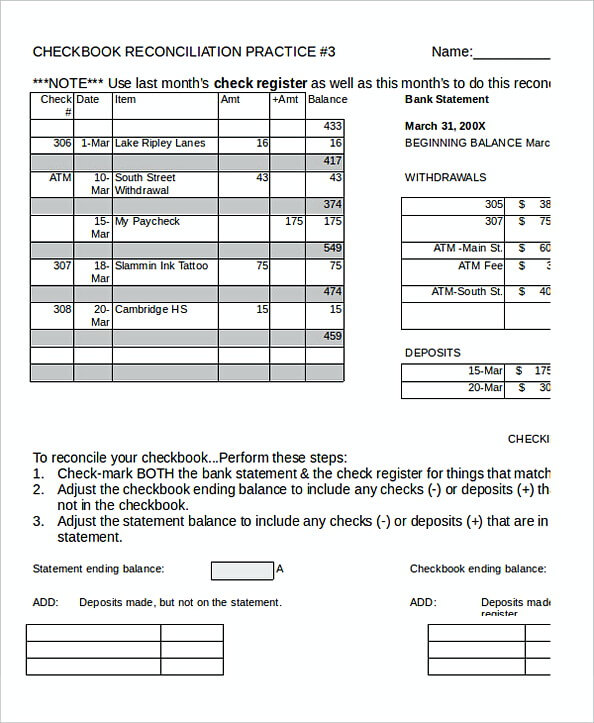

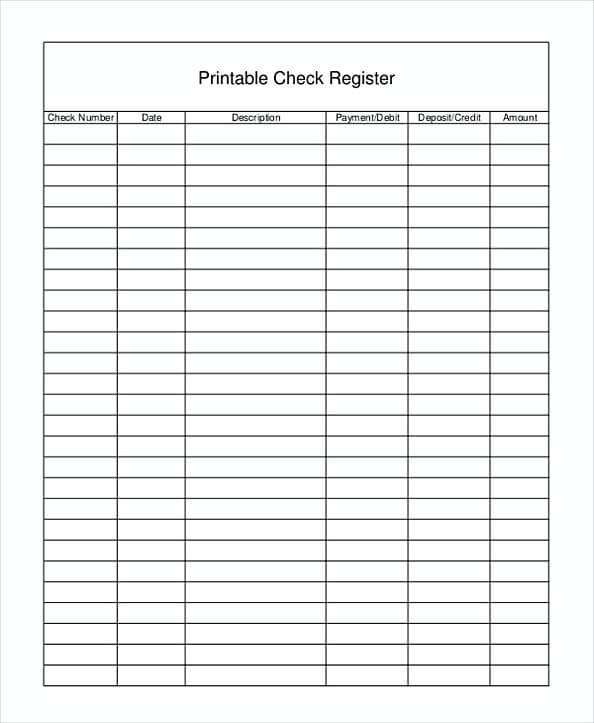

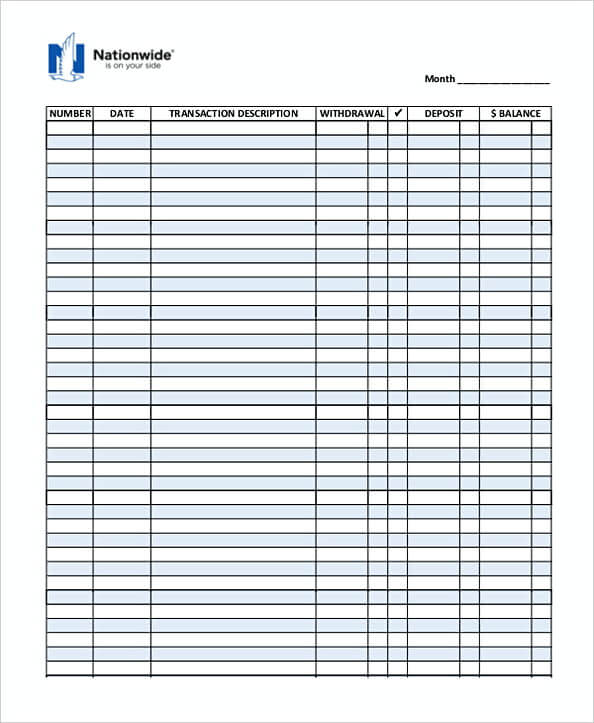

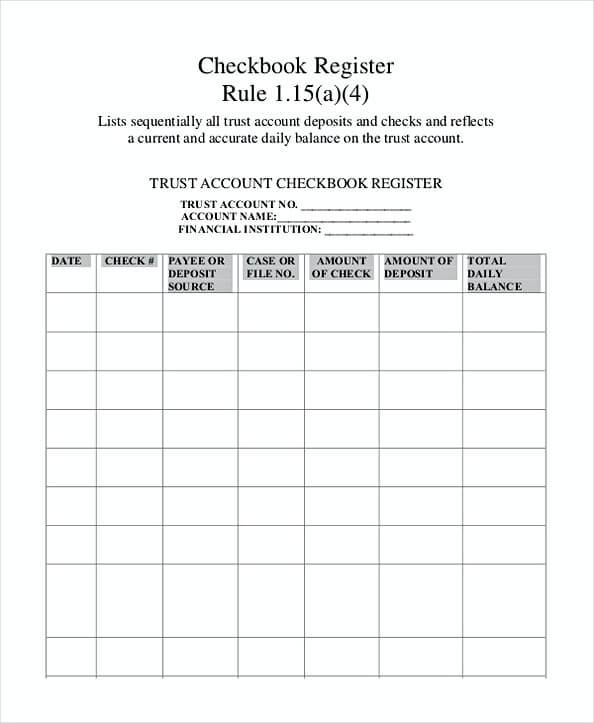

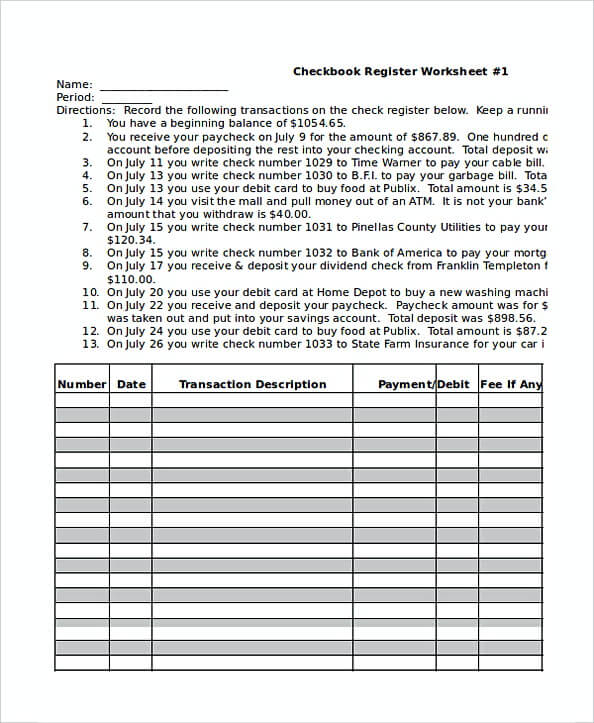

A check register template is basically the cash disbursements journal to record your cash payments, checks and also the outlays. This comes with columns detailing on the check number, date, payee, credits, debits and account names and others that are related with the transaction.

Normally before the transactions are posted on a general ledger, the bookkeepers will file the transaction in the check register. In many companies, this check register template is very useful to record their transaction. For instant is when a retailer has so many transactions from the salaries expense, accounts payable, inventory and so on. Also, the manufacturer that have so many entries to file including the raw material purchase, production cost, inventory and so on. This book will help them making the best financial arrangement so the cash flow will be clear. Compared to the bank accounting, for a business, this is the best thing because it can be adjusted based on the condition and details that need to be written. In the future, the company can examine the report to make a decision which will be cut off and locate the fund for the productive project.

What Does The Check Register Template Cover Under It?

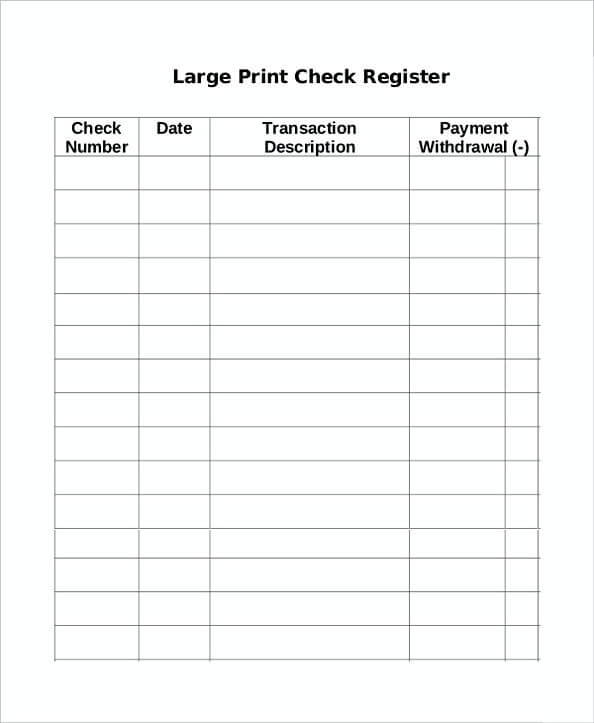

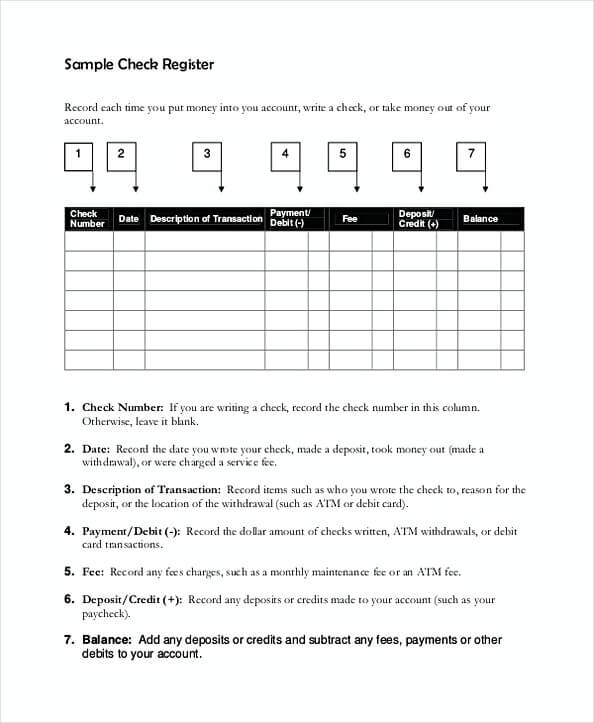

Generally, a good and simple check register will contain certain details as follow:

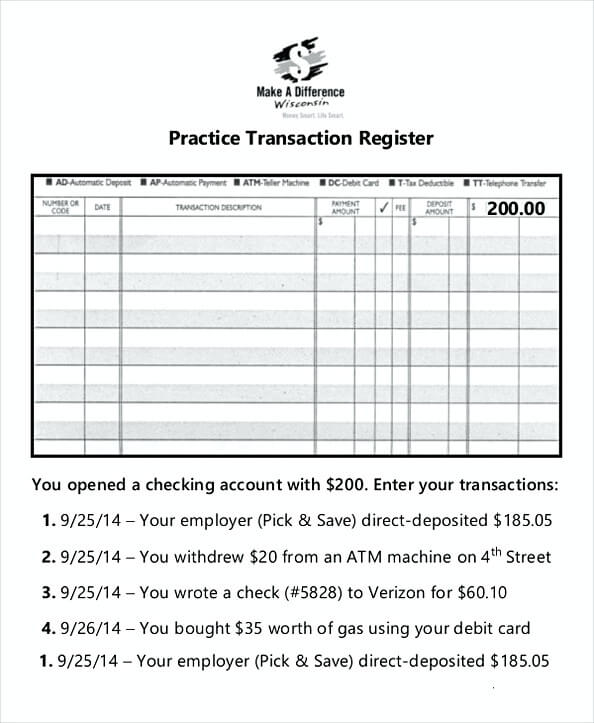

- Check Number – You can see the number of the check is on the right-hand side. Some checks also appear on the bottom. However, you don’t have to worry much because the number of the checks will be chronological.

- Date – Make sure you notice the day you write the check and for whom you write it as well as the amount.

- Description of the Transaction – The description of the transaction will record to whom the check was given and you can write the name of the person as well as the company if it is possible.

- Payment and Withdrawal Amount – Include the exact payment whether you use the debit or credit card or even through online banking. Write the withdrawal amount in another column section.

- Fee Amount – You might find there is fee amount during the transaction. This kind of thing is trivia but never underestimate it when you have a busy transaction, this has a huge amount.

- Deposited Amount – This describes the number of money you deposited in your check account.

- Transfer – If you have more than one account and want to transfer some amount to the next account, write it down in the different column can help you track your money.

- Balance – The balance should be based on the transaction you make.

In this modern day, people might prefer using an account bank statement as it is considered more practical. However, when you have too many transactions with the different field in your business, probably this will lead you to miss out certain details that might help you decide necessary things.

- Sample Training Manual Printable

- Template Background Check Authorization Form

- Sample Painting Estimate Template

- Sample Landlord Reference Letter Template

- Sample Wedding Guest List Template

Using a check register template helps you get the real-time information, tracking, reduce unnecessary cost, aid budgeting, recording payments. Most importantly, you understand the cash flow.