Hardship letter is the letter that will be useful for loans and mortgage case. This letter is mostly used to protect the loss that might happen in the agreement. As you can see, a loan agreement will have two parties.

If one of the parties can pay or fail to pay the mortgage or the loan they have been agreed then this letter will help to prevent many loss of the loan’s residence due to the failed payment. It means it will help the other part to get their financial right.

Why This Letter Is Helpful

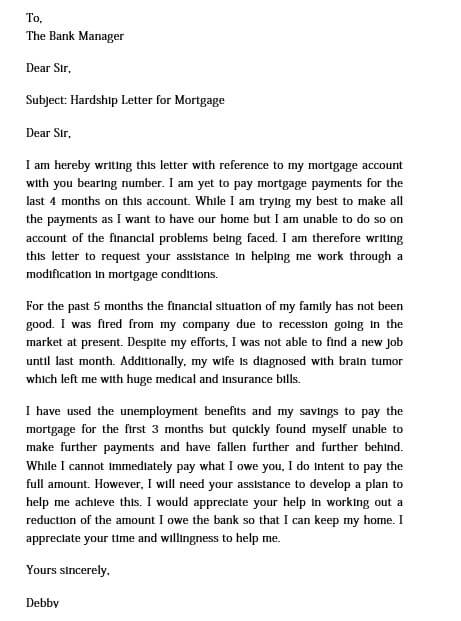

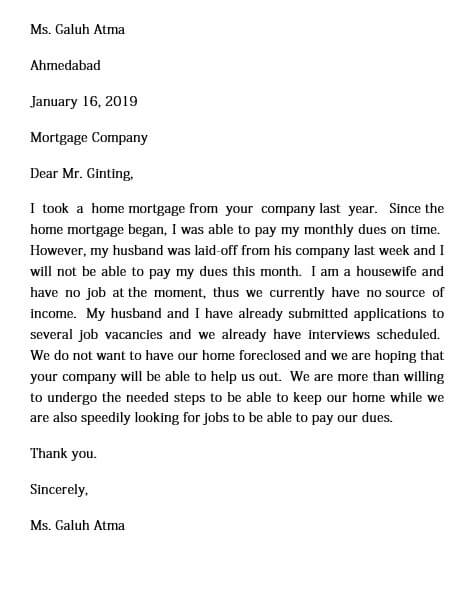

Many people may not know or aware that the financial loss of the broken agreement can be prevented. This letter is made is to explains about the case. It contains with the reason why the other parties can’t fulfill their duty to pay the money they have to do.

It seems easy to claim the loss by writing the letter. In fact, you have to make the proper letter for the unfortunate case that happened to you. If you feel confuse or find difficulty then you can take a look this sample financial hardship letter.

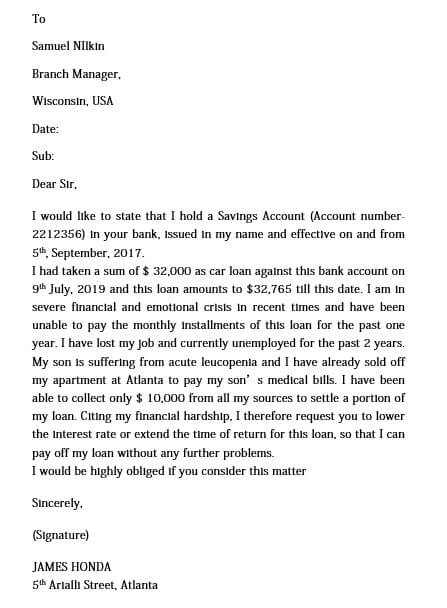

There are various types of letter template that you can use. You do not have to write again along. The template is already provided as free with the blank sheet. You can write down the blank sheet with the information that is related to your case.

Of course, you still have to write the complete information with factual description. But, you can choose one from various models that helps you the best to write the correct one. One of the examples that you may take interest is the short sale model that is provided here.

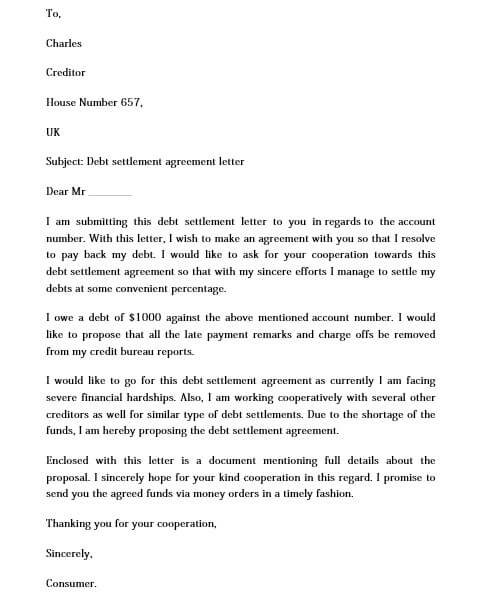

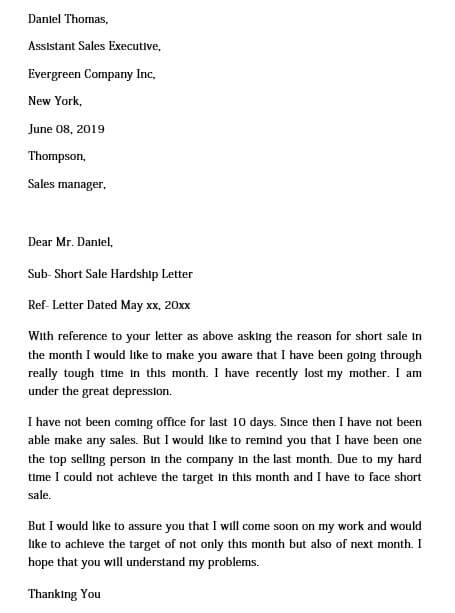

The Short Sale Hardship Letter

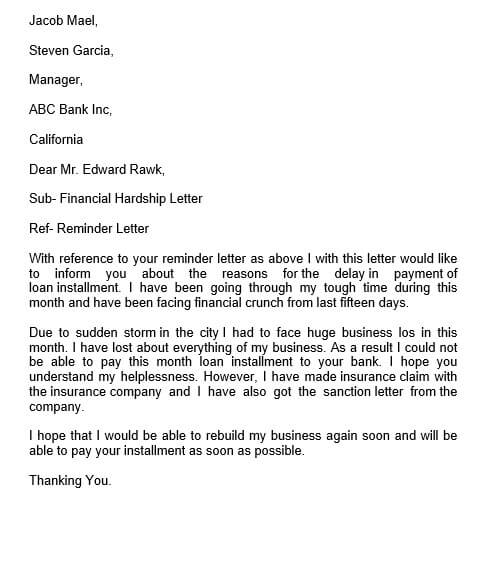

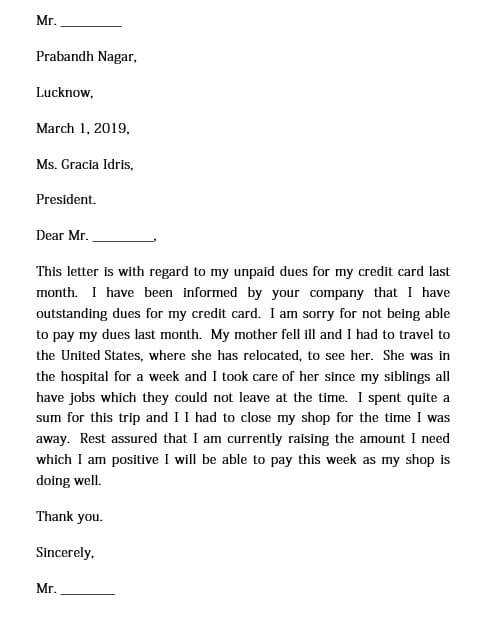

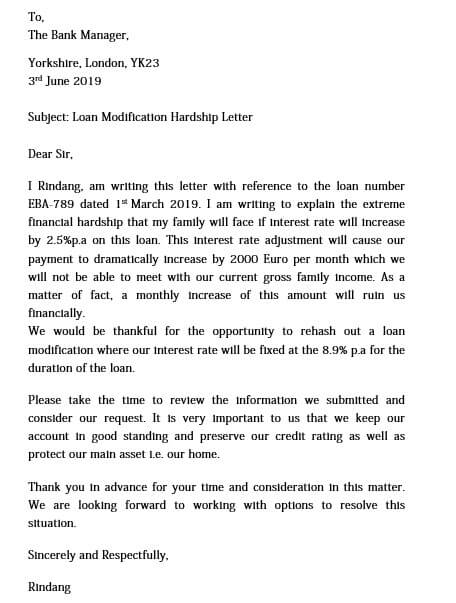

This letter is created to clarify and to give complete reasons why you can fulfill the target of the payment or income. Making this letter is easier since you do not need to add logo of the company or anything related to it.

Put down the complete name of the receiver along with the position the person has. Then, write down the company address and the date when the letter has been made. Always open up your letter with a welcome sentence.

It is highly recommended to give sub in your letter. You can write several paragraphs. But, it is highly recommended to divide the paragraphs into three sections. The sample hardship letter helps you to write the information in more brief way.

Explain about the reason why you cannot fulfill the financial agreement that both of the parties have been agreed about. Then, emphasize that you have a good intention to take care of the problem and being responsible about it. Make sure that he receiver will take your promise.

As you make this letter means you know about the consequence about your act, causing failed financial payment. It’s much better if things like this won’t happen again. Leave a positive message that you will take care of the problem. Then, always say thankful in hardship letter in the closing.