How to Make Pay Stub Template and What Has to Be There in the Template Content

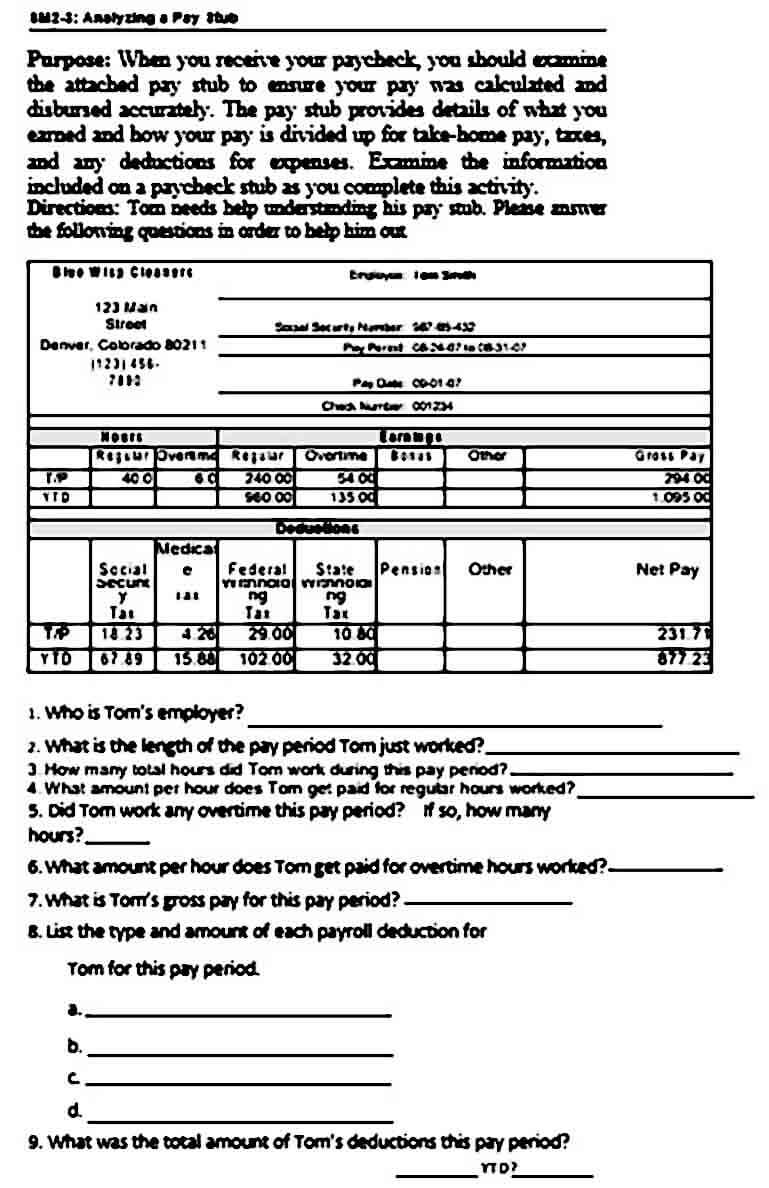

You must have your own employees when you run a business, right? It can’t be done on your own, especially when it has grown big. Now that you have employees, you have to pay them for their work, of course. You will need pay stub template to help you with that. Are you wondering why?

Well, this is the very template that can convert employees’ work hours into salaries. Doing it manually with great number of employees will take forever, but it won’t be so with this template. You just need to know how to make it.

Step 1 to Make the Pay Stub Template

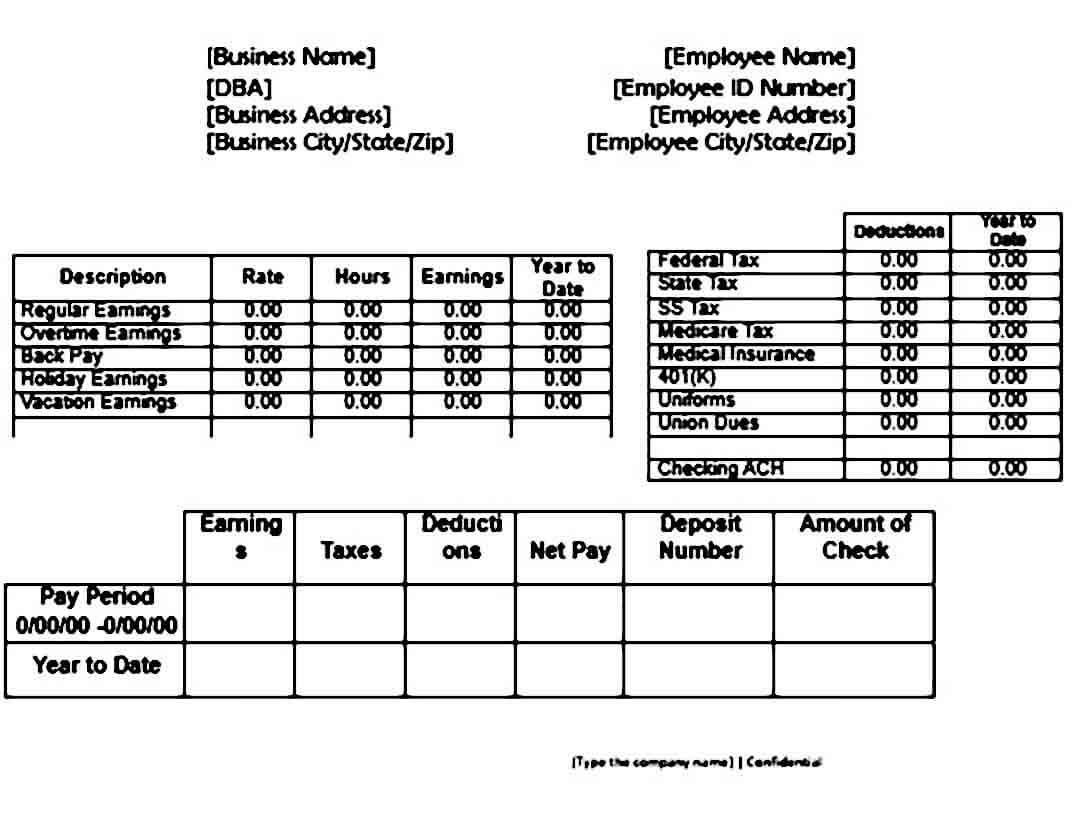

For sample, let’s go with the simple one. To start things with, you need to make the company name as the heading of the template. Follow the name with “Pay Stub” since we are making one for the employees of our company. You better make company name so as to not mistake one from another.

- Liability Waiver Forms Template

- Sample Vacation Rental Agreement Template

- Printable Restaurant Business Template

- Template Printable Job Aplication Form

- Sample Progress Note Template

Of course, you can add more specific detail about it, like specific month of the year. Then, you can look into it later easier when needed. After all, you need to make monthly payment to employees. Employee pay stub is right to go with.

Step 2 to Make the Pay Stub Template

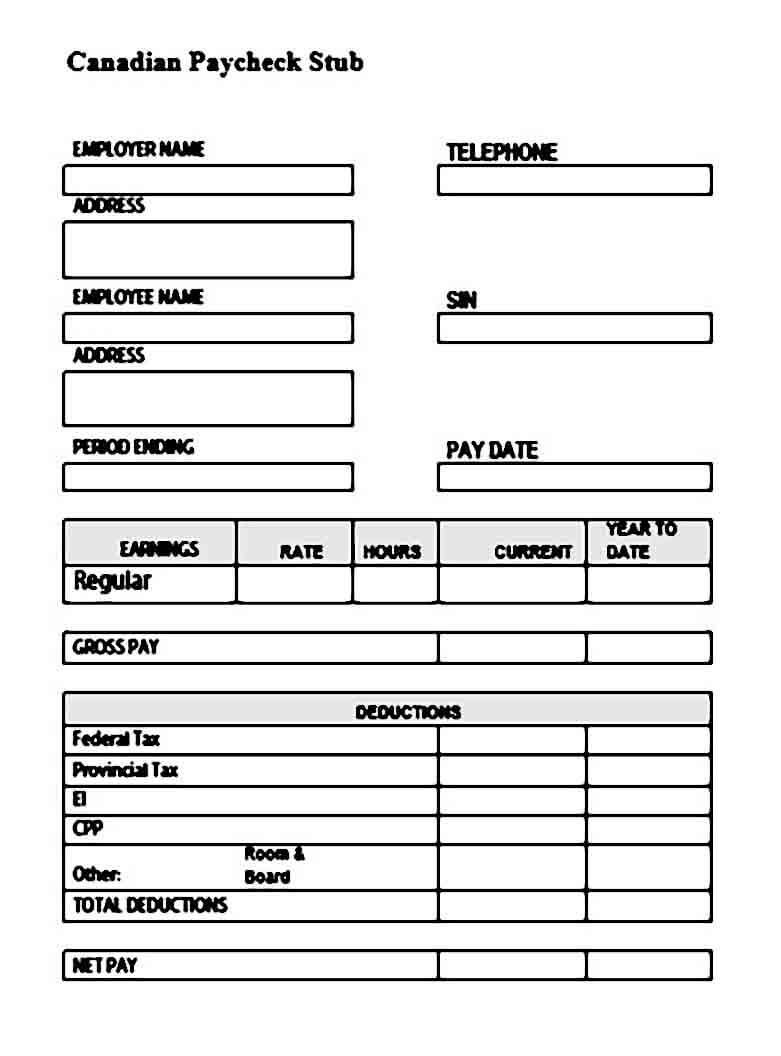

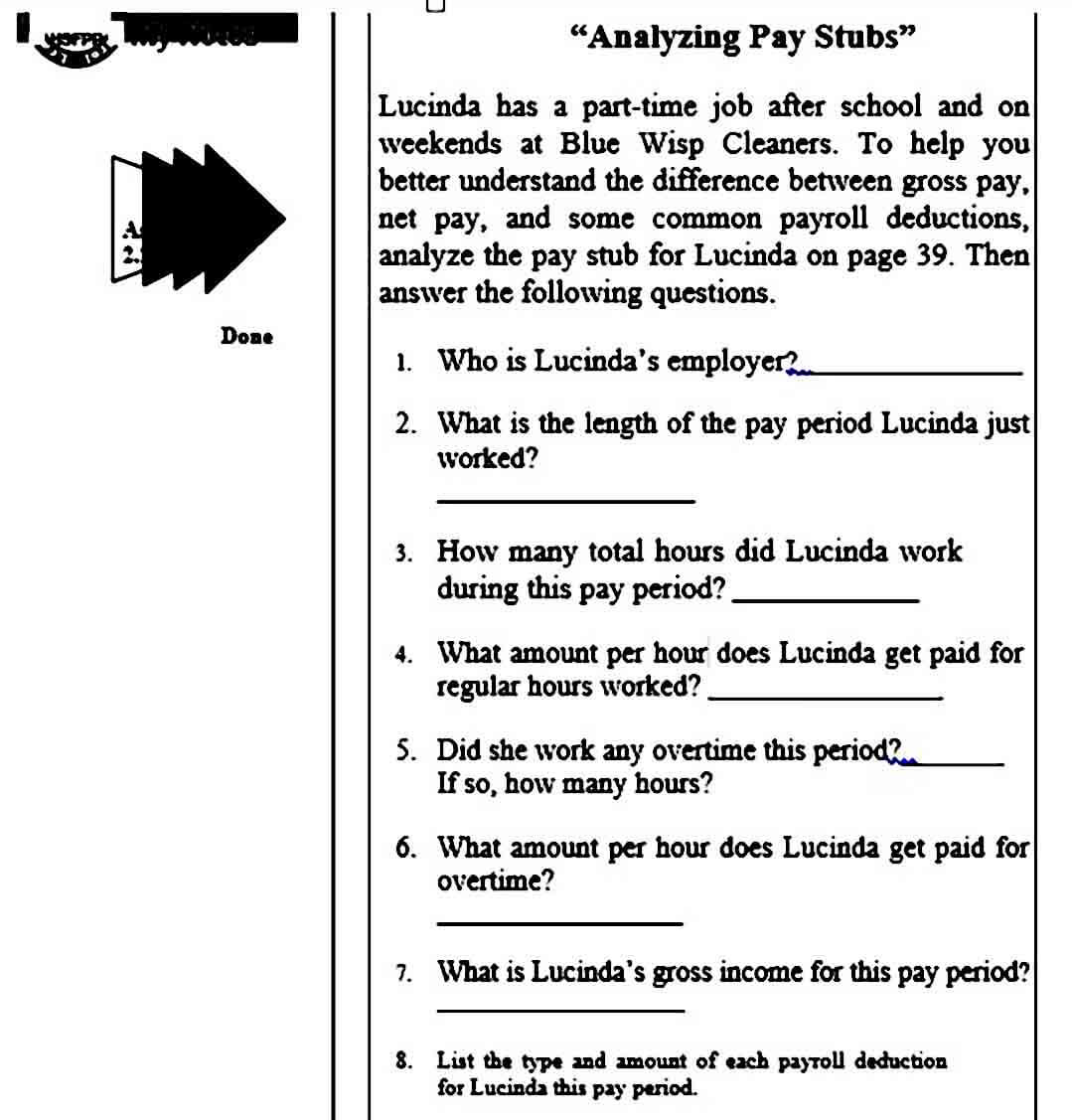

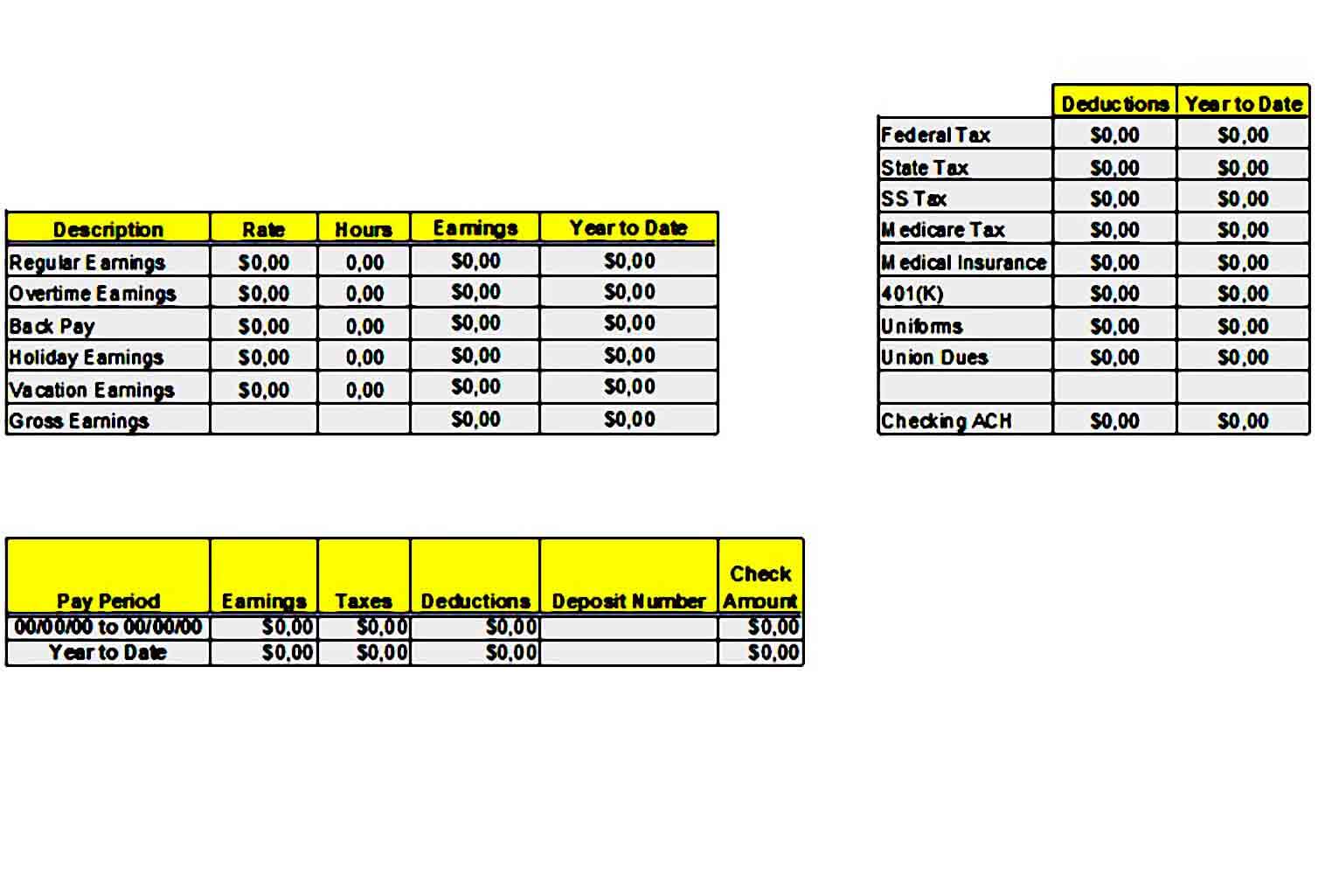

From here, it is better for you to make a table. You will make things look neat and organized this way. The first column can go with the employee number. It is some sort of ID number that employees have in the company they work in. It differs from one another to identify each of them.

The next big column will cover three sections. Those sections are employees’ hours worked, rate, and amount. Basically, these are the things that must be there in pay stub when calculating how much salaries the employees could get.

Step 3 to Make the Pay Stub Template

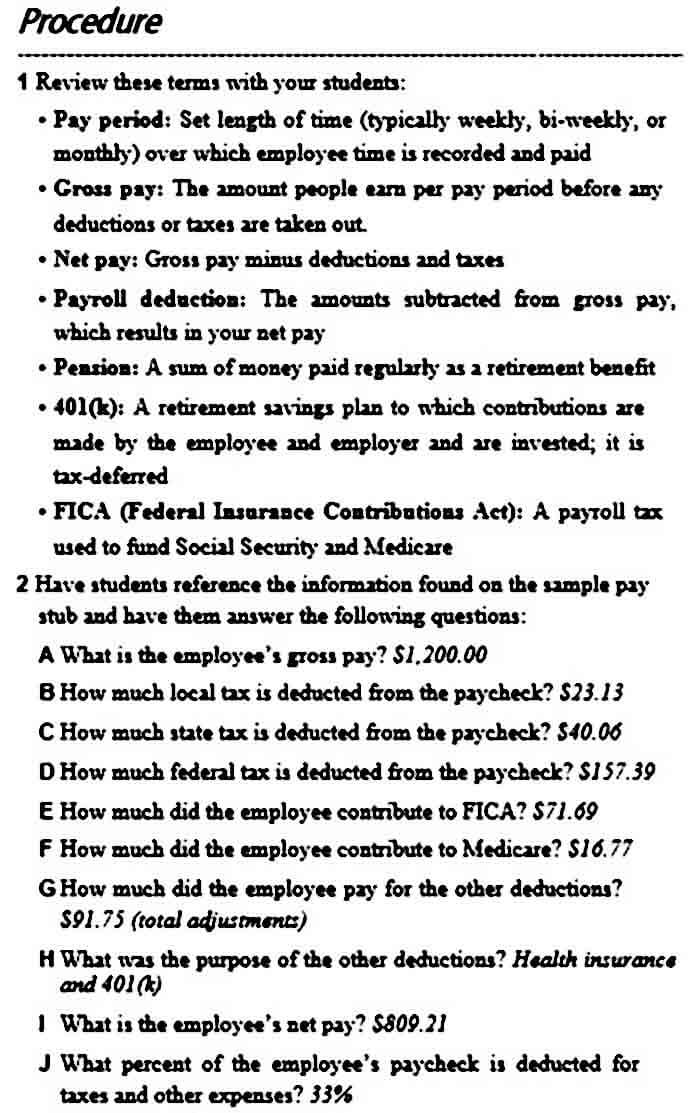

We have another big column to make, next. This time, it concerns about employees’ withholdings. There are two pay stub sections for this column. Both of them are deductions. When it comes to deductions, there might be federal tax, provincial tax, and other things to be included in this part.

The last column will be the amount of the net pay, of course. The net pay is the total salary the employees can get by considering their hours worked, rate, amount, and deductions of their withholdings. It will always come last.

Step 4 to Make the Pay Stub Template

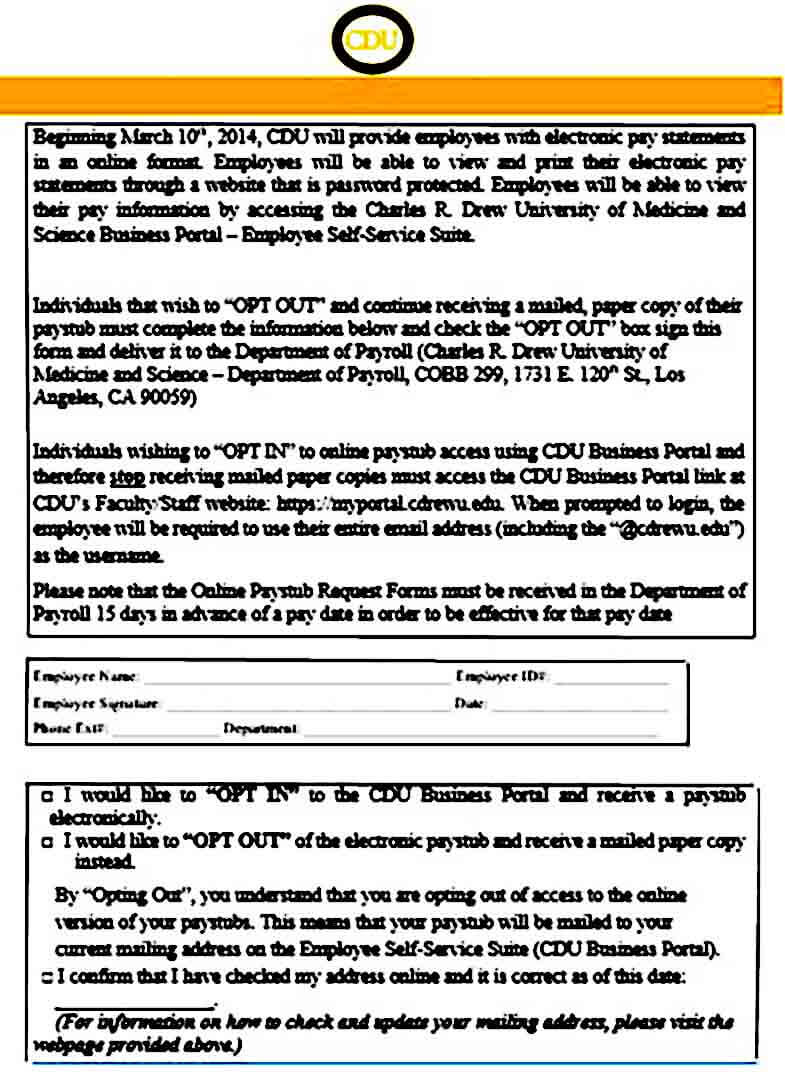

Basically, the table is the main focus of the template. You are done with the table only if you just need to calculate employees’ salary and be done with that. However, if you want this template for report or record, you can follow the table with employer signature and the date of pay stub is made.

Once it is done, you may add the employer address and phone number as well. After all, you are the one responsible for everything related to your employees like this. Pay stub template can simply be made this way for employees’ salaries.