When you want to borrow some money, the lender will use the credit score to calculate the risk. Therefore, having a good credit score chart can give you mortgage rates and also low-interest rates for the credit cards. This is a way of measuring the credit-worthiness in front of the lender whether it is a bank, a company or others.

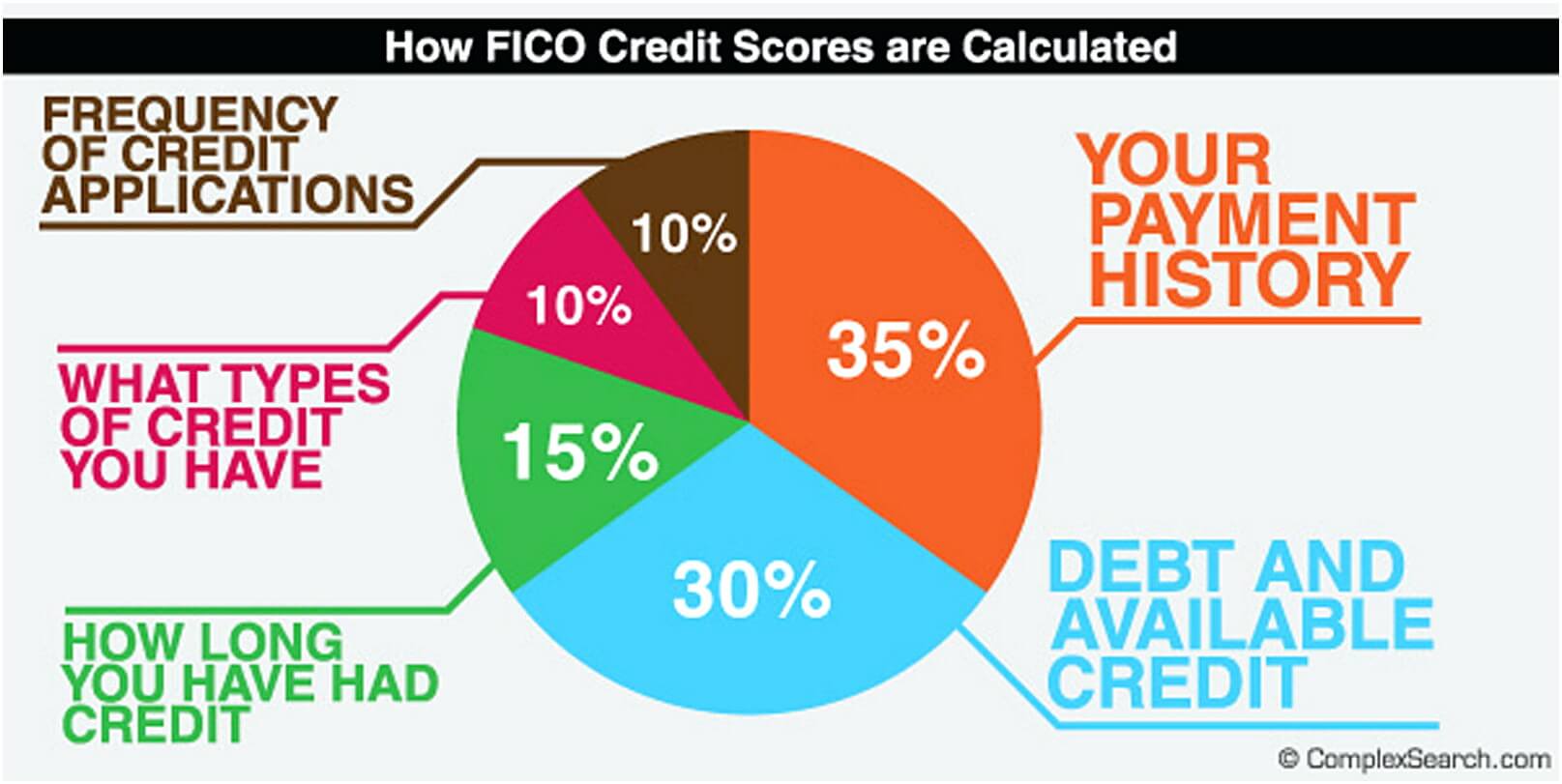

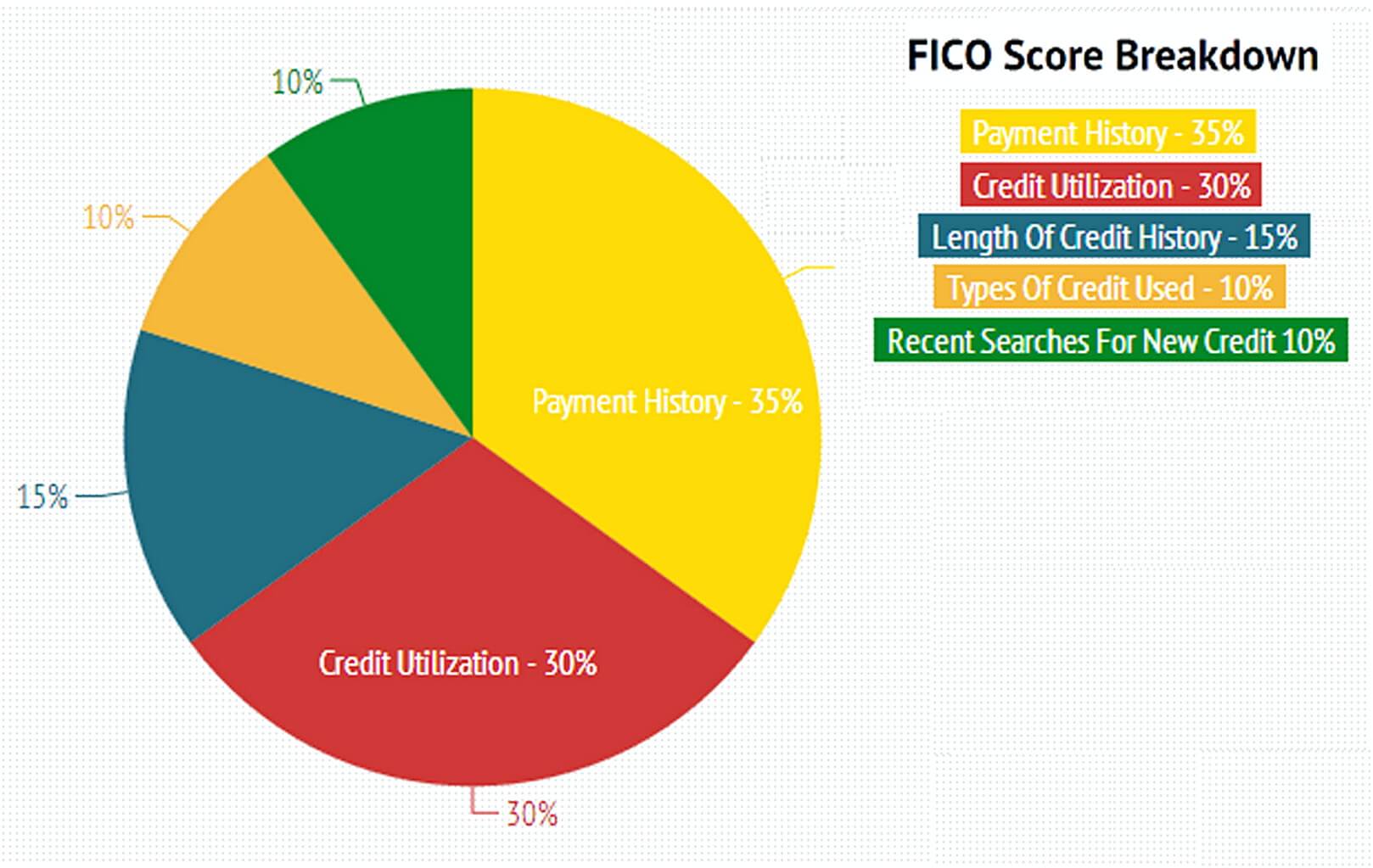

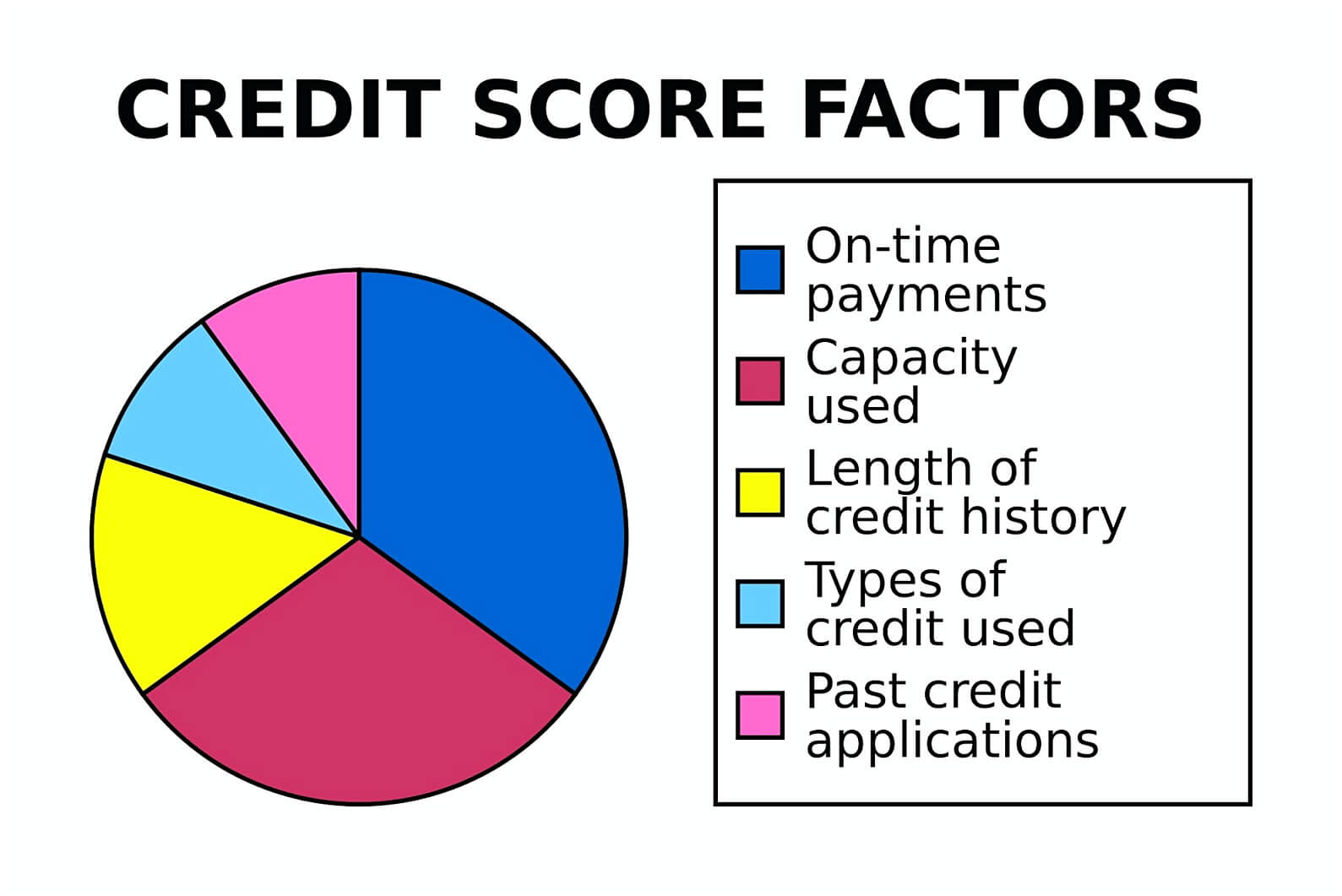

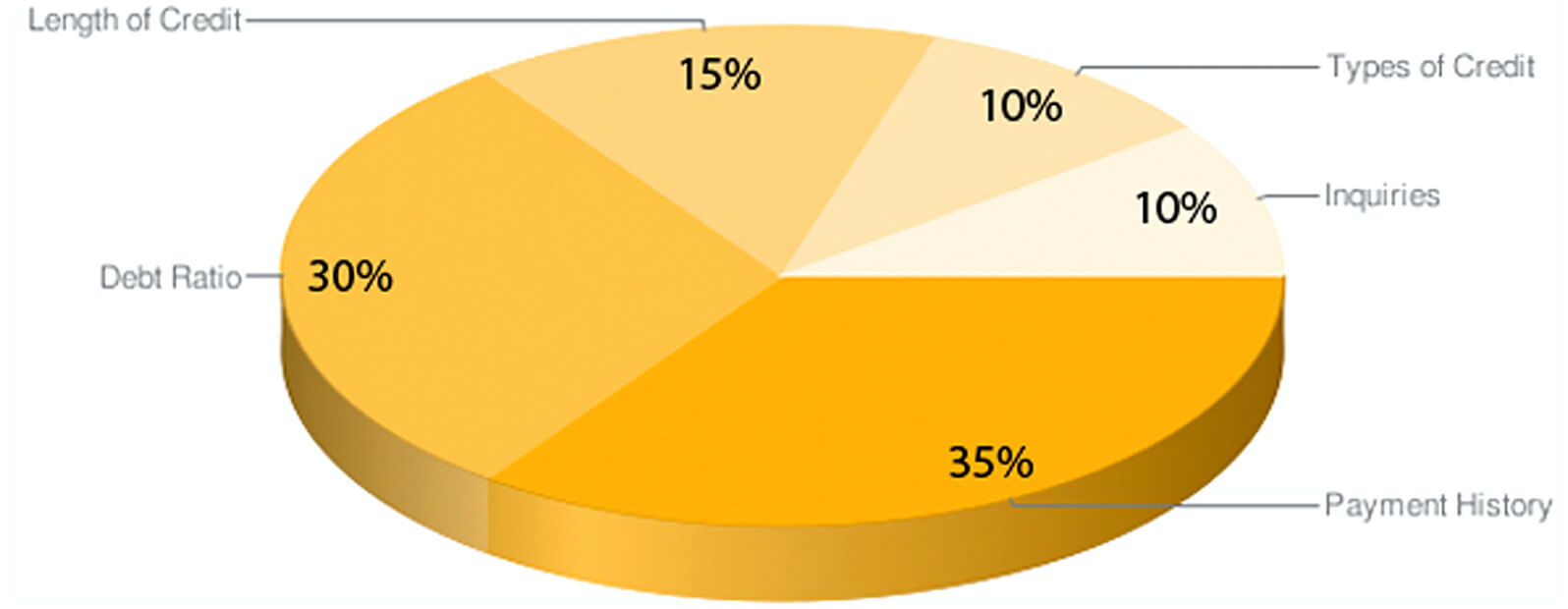

You must have a good credit score if you pay the bills on time and you also only use a small amount of credit percentage. Conversely, when you ever faced the bankruptcy, bills, collections, defaults and other negatives thing you score will be lower.

Today people tend to be more dependent toward credit, from education, business owner, professional and so on. Hence, this is becoming the essential thing to maintain your credit score by trying to pay everything on time so you will have a good track record because basically the lender will look upon your worthiness from the history.

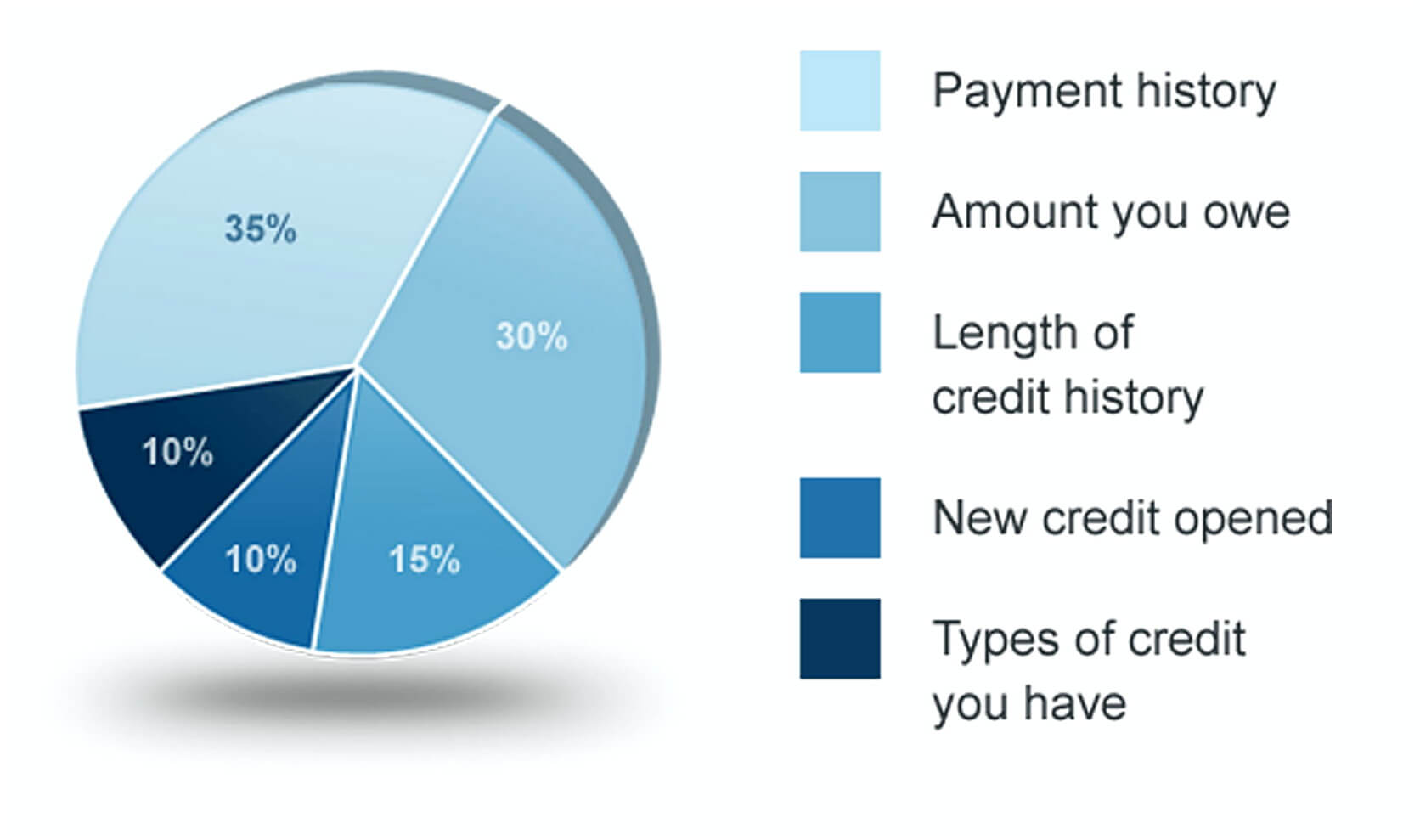

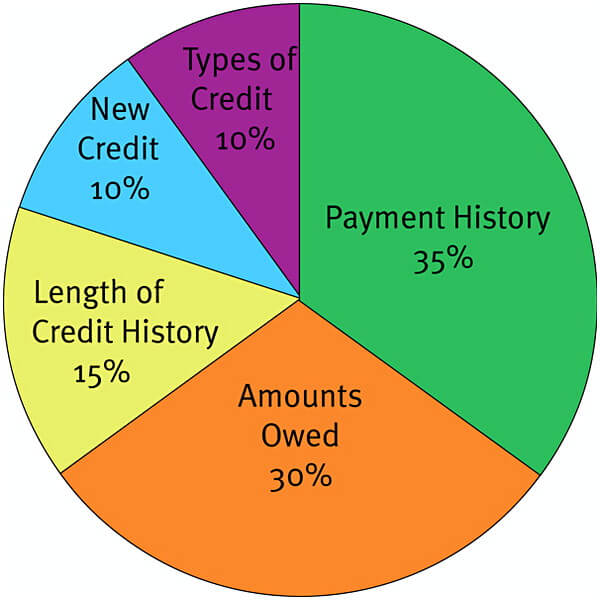

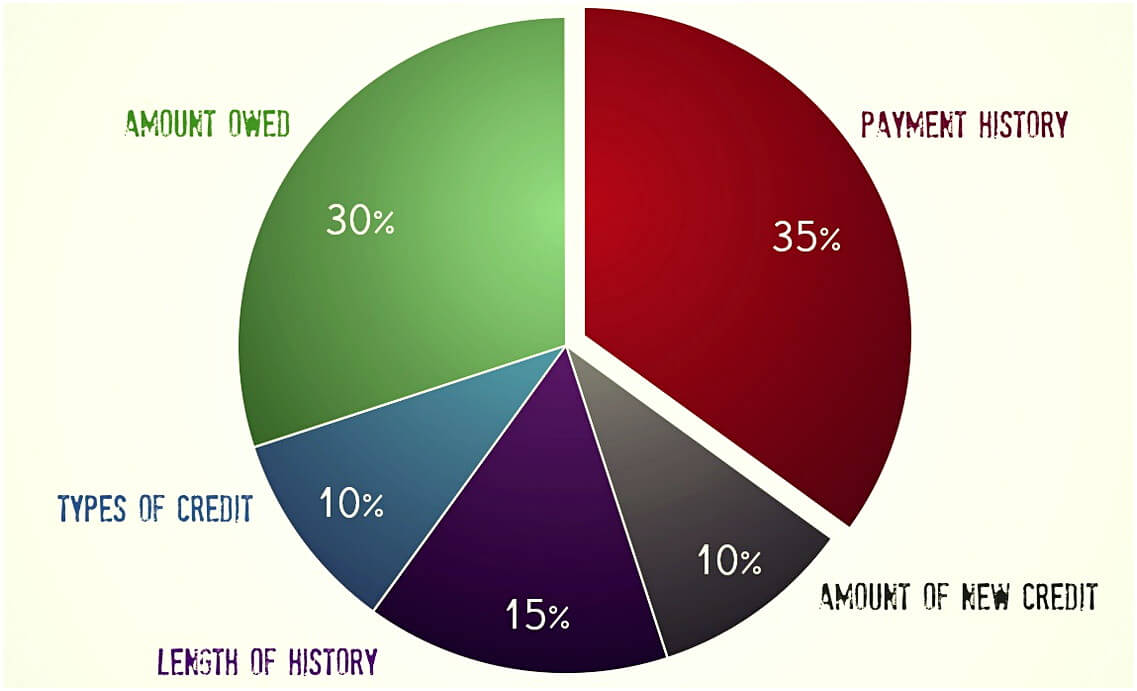

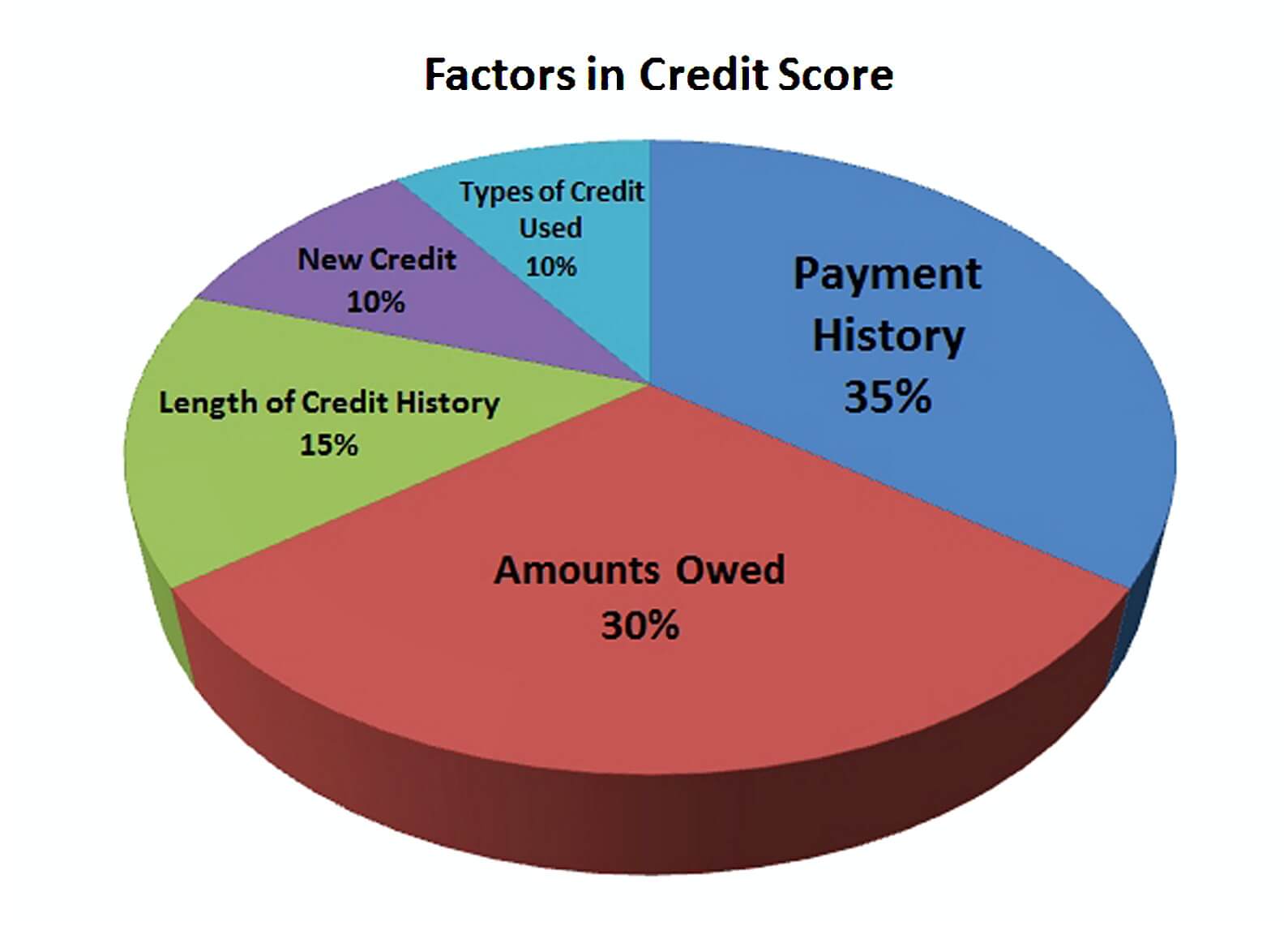

Another popular term of credit score is the FICO score which was started by the Fair Isaac Company with 3 digits that represents how the creditor will pay the debts. It sounds rude, but actually, the credit score helps you keep your financial stability and determine your worthiness whether you will be good at borrowing or not.

How To Know If Someone’s Score Ranges Bad or Good?

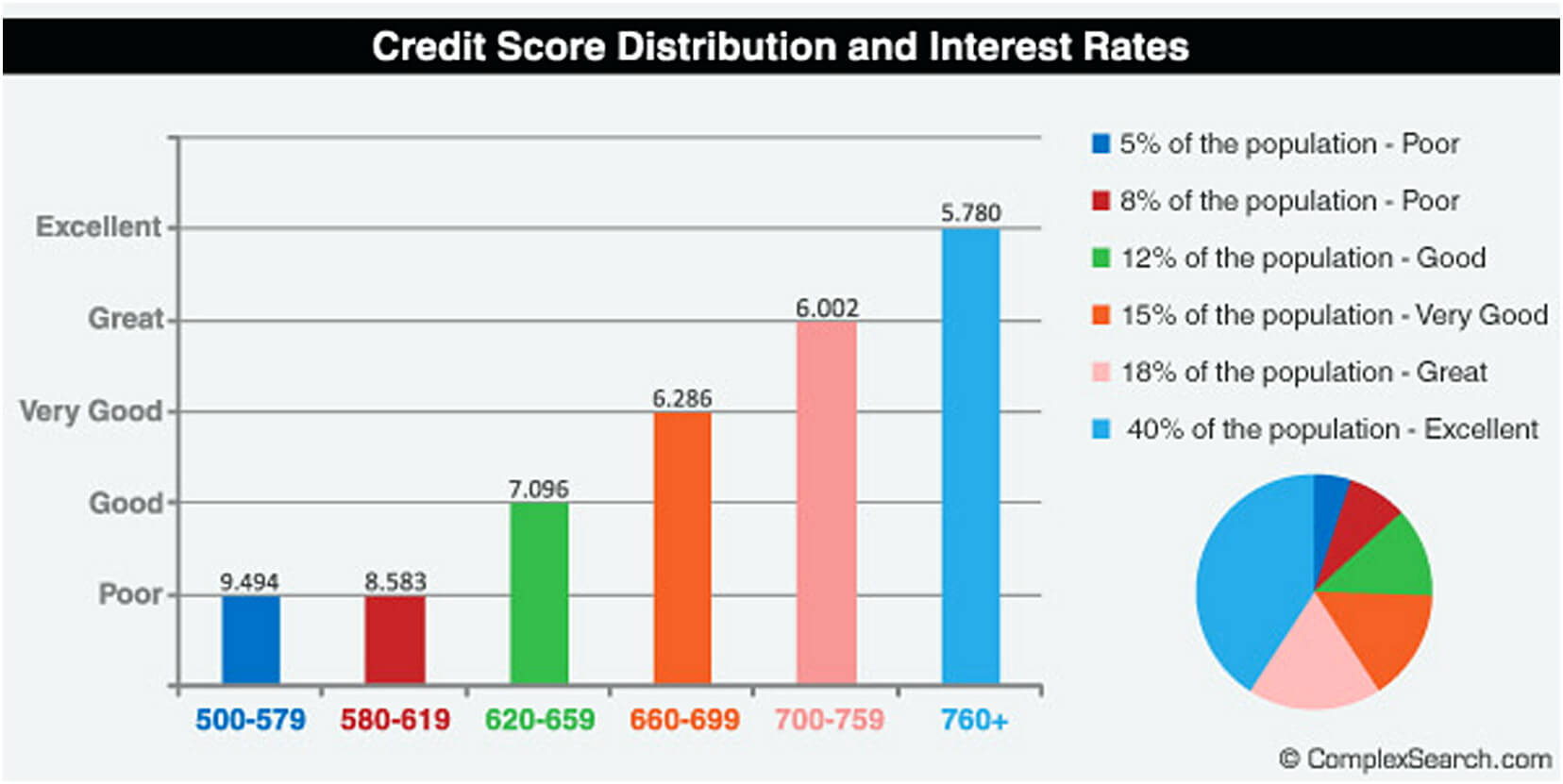

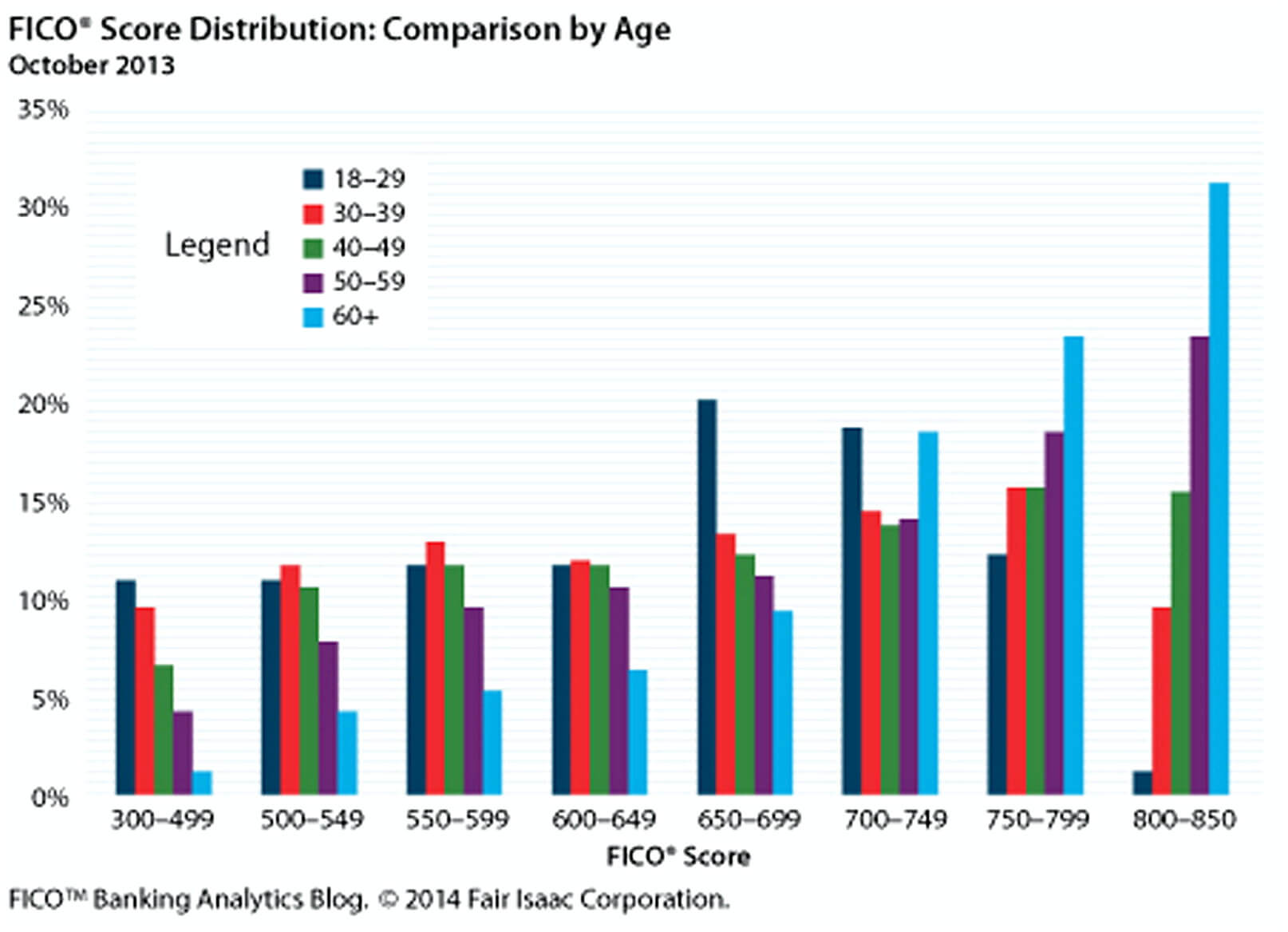

However, a credit score varies that it is based on the calculation method. Both VantageScore and FICO give range to score from 300-850 with different classification and method. In this case, both have the same application that the higher the score is, the lower the risk for the lender.

- Credit Score 800-850 – People with credit score range from 720-850 are considered the most consistent in fulfilling the responsibility when this comes to the lending case. They absolutely get the lowest interest.

- Credit Score 740-799 – People with 740-799 indicates they are financially independent and responsible. They usually will make the payment including utilities, credit cards, and others on time. Usually, people with this score have low credit card balance.

- Credit Score – 580-669 – Someone who has this credit score is considered fair or in the average category. Usually, they have some problems regarding their historical payment and lenders will usually give competitive rates.

- Credit Score Under 580 – This is considered as poor credit score which this person should talk to the financial professional to help them repair the credit.

- No Credit – But if your score is under 350, probably you need to discuss it with your local lender for the borrowing requirements. Especially if you don’t have a credit history, and then set up your responsible payment to make good credit record.

To boost your credit report is an important thing because it not only helps you maintain your financial balance but also will give you the lowest rates when someday you need to lend some money. Be wise with your spending and don’t spend it on something you don’t actually need. Also, pay your bills on time.