What Is A Pay Stub?

A pay stub is a paycheck document that is issued by the company after they deliver the payment to the employees. This document is more like a notification that functionates as the pay advice, payslips and also the check stubs. This gives many benefits to the employee to re-check the payment details and understand the information, for example, any kind of deductions. For the employers’ side, they have the payment proof.

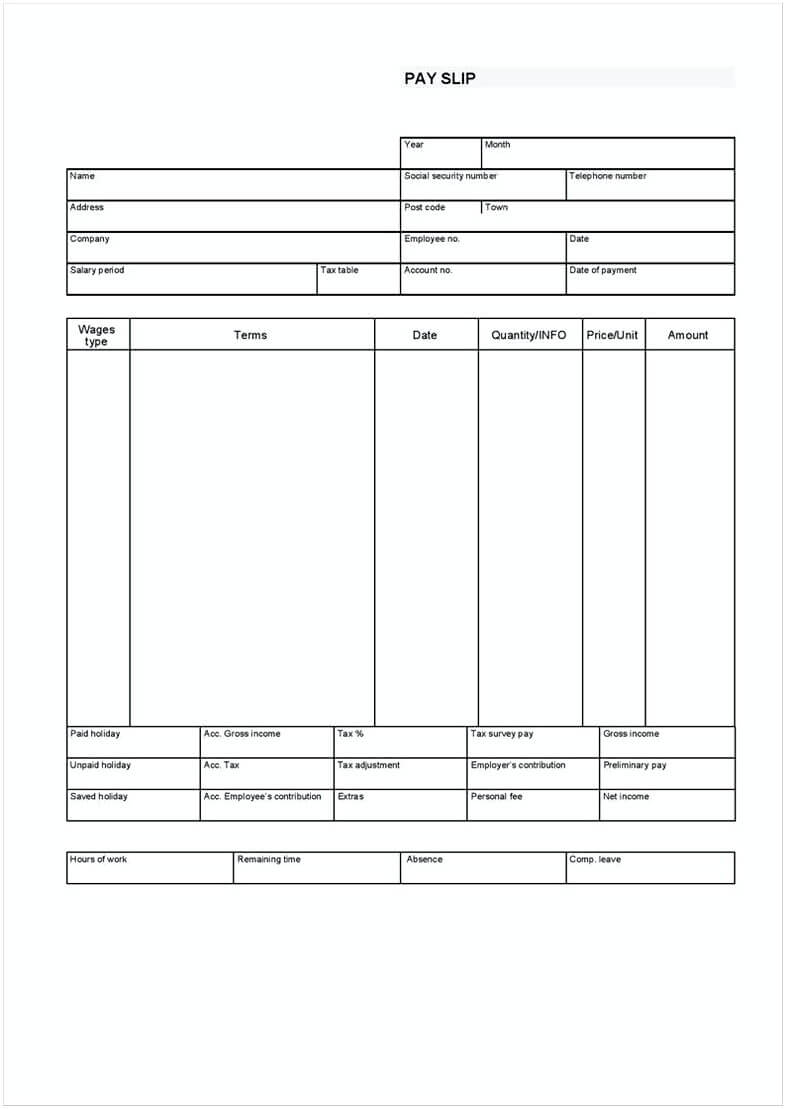

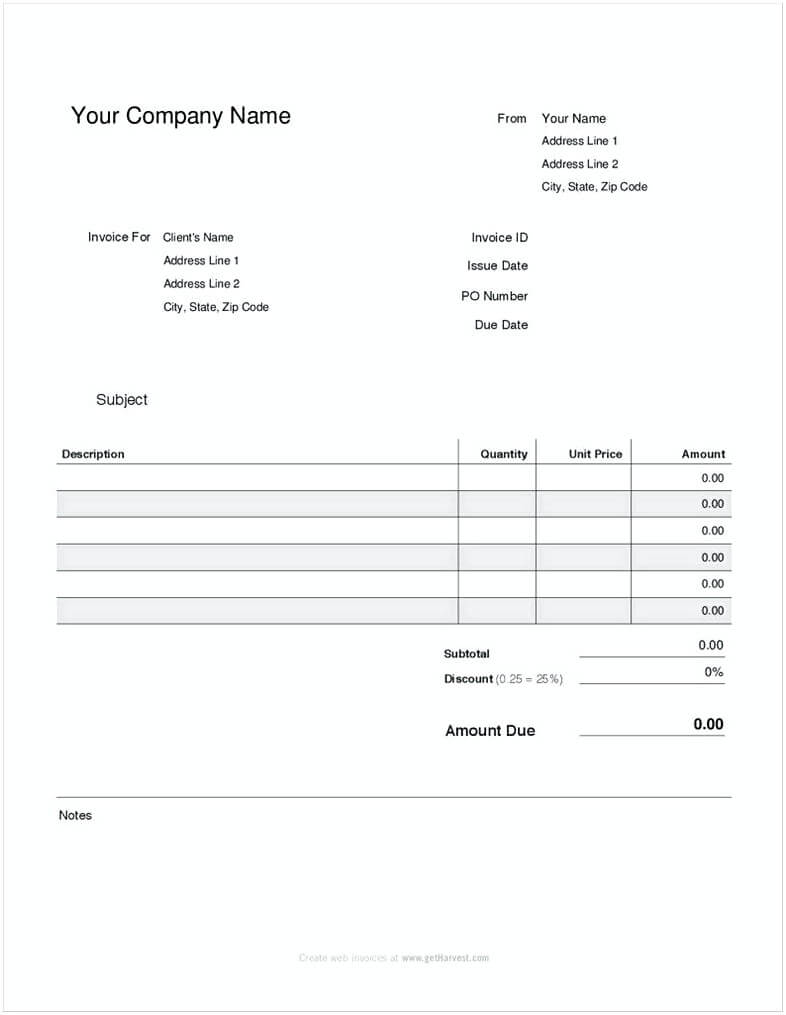

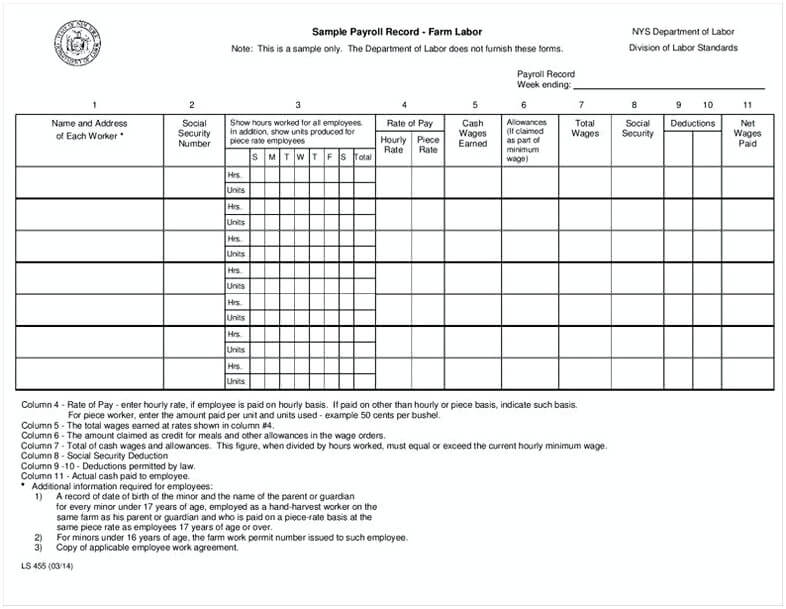

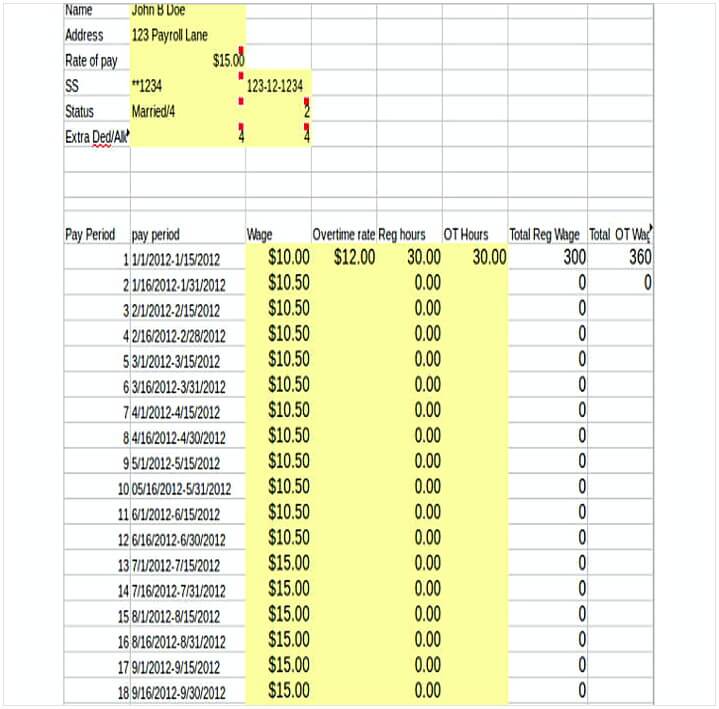

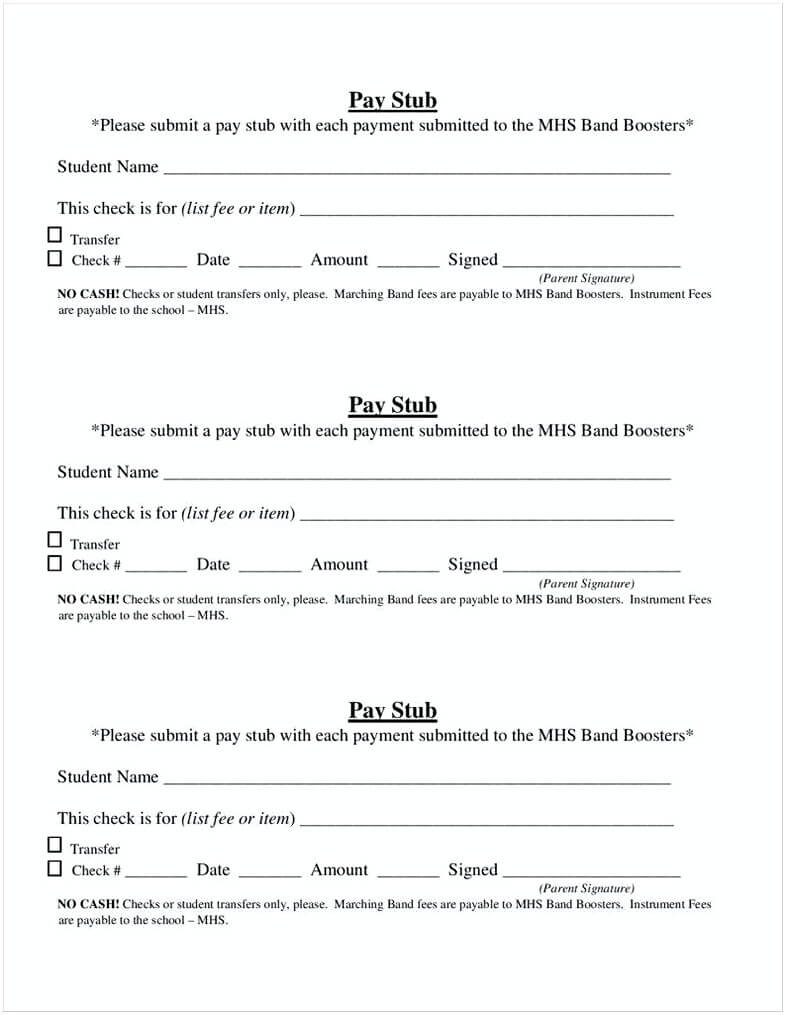

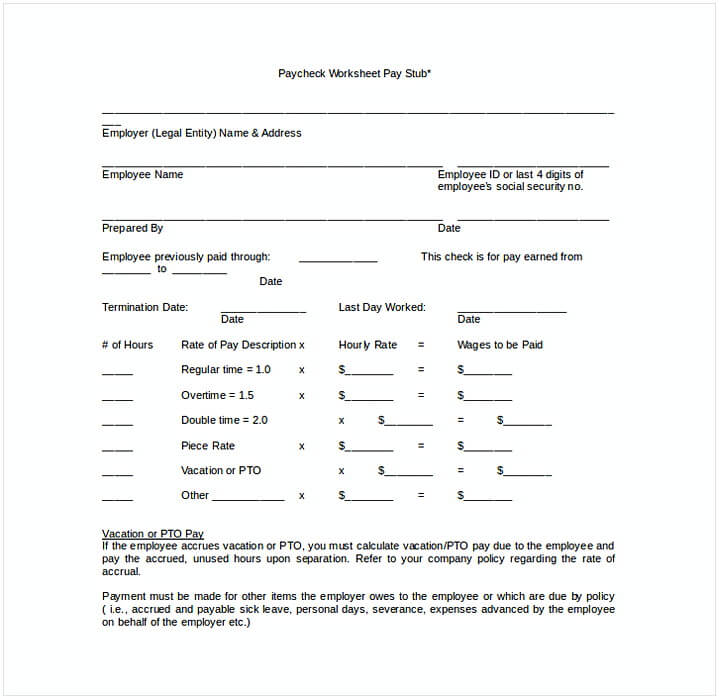

Each company has a different format of pay stub ad they design it in a certain way to make the employees understand the information stated. Meanwhile, for a small business which is developing, using the pay stub template might be very helpful.

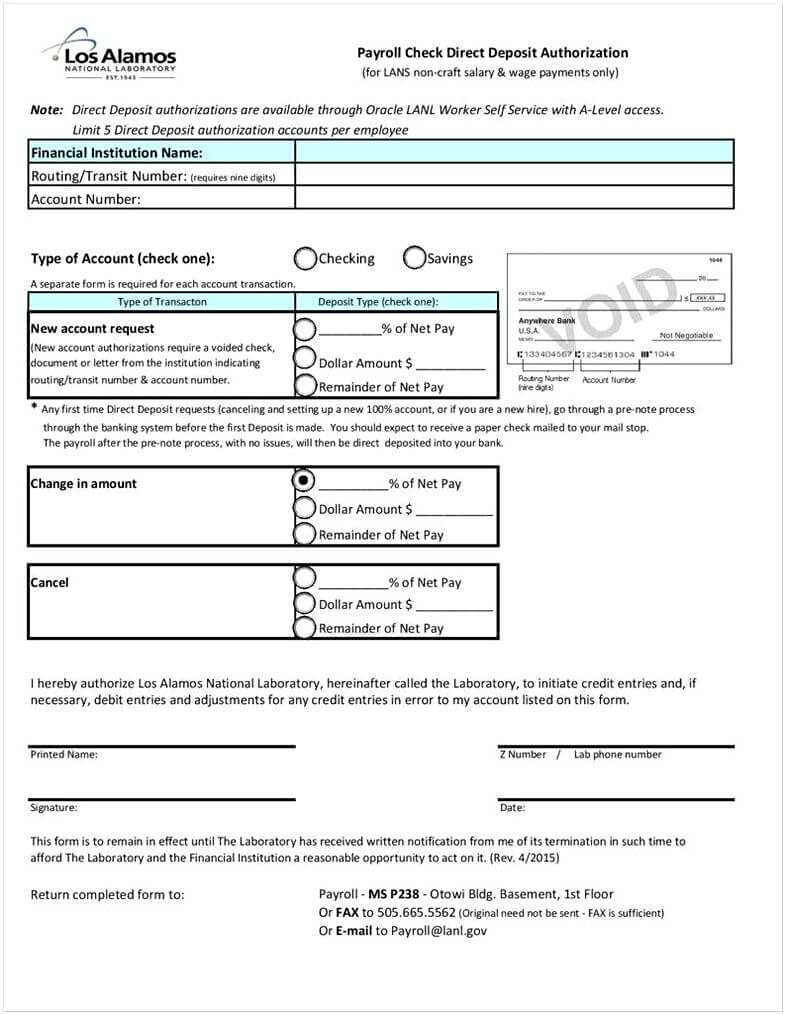

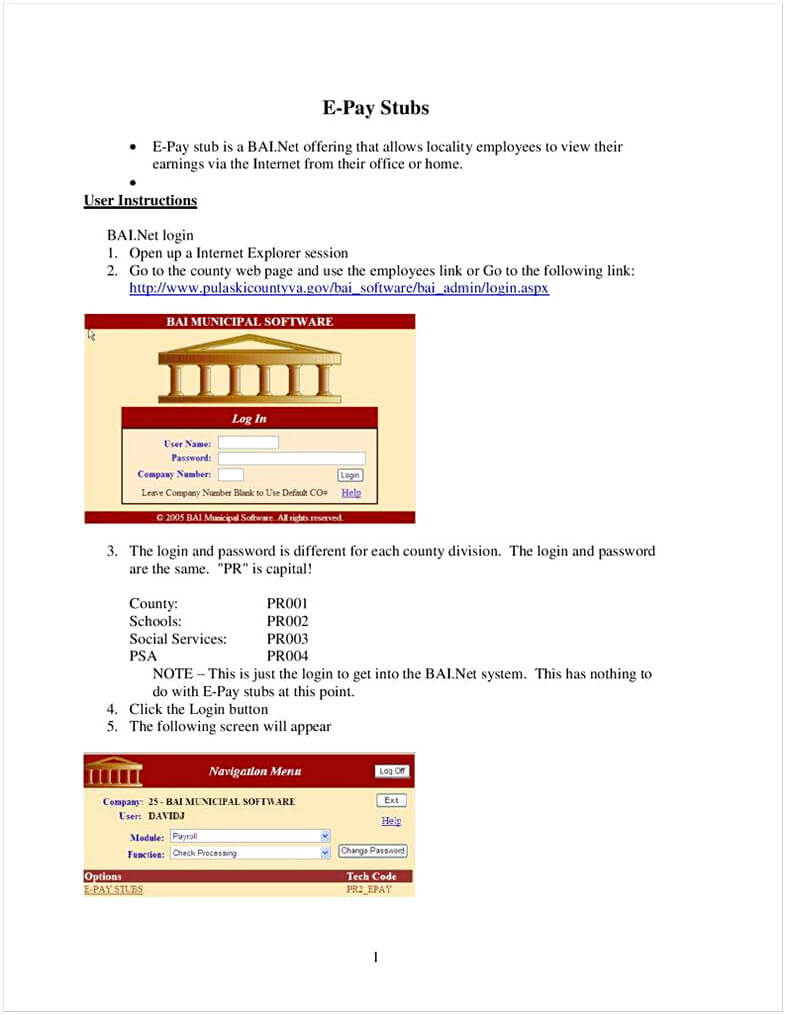

However, using the pay stub template doesn’t mean we have to give it in the printed form, we can use the paperless option, for example, delivering it through a bank account. The benefits of this paperless option are you save more money and it is easy to track and more secured because you deliver it directly to the bank.

In this case, if the employee is paid through direct deposit, the paycheck will be included through online and they can log in the paycheck with the username and password given by the company.

In the future, an employee can use the paycheck for a crucial thing like a loan or renting an apartment or even for buying a house. They will ask the pay stub in a certain period of times to make sure you have a stable income or not.

What Kind of Information Do We Add In The Pay Stub?

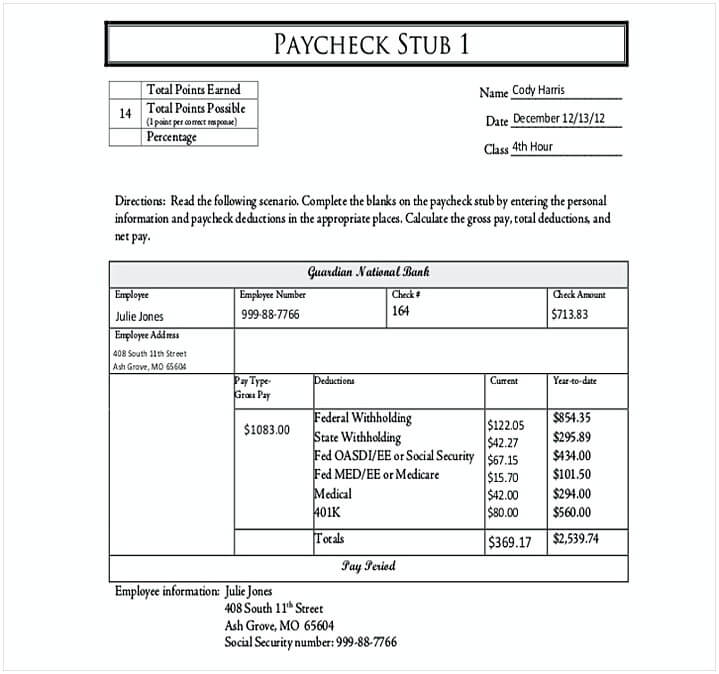

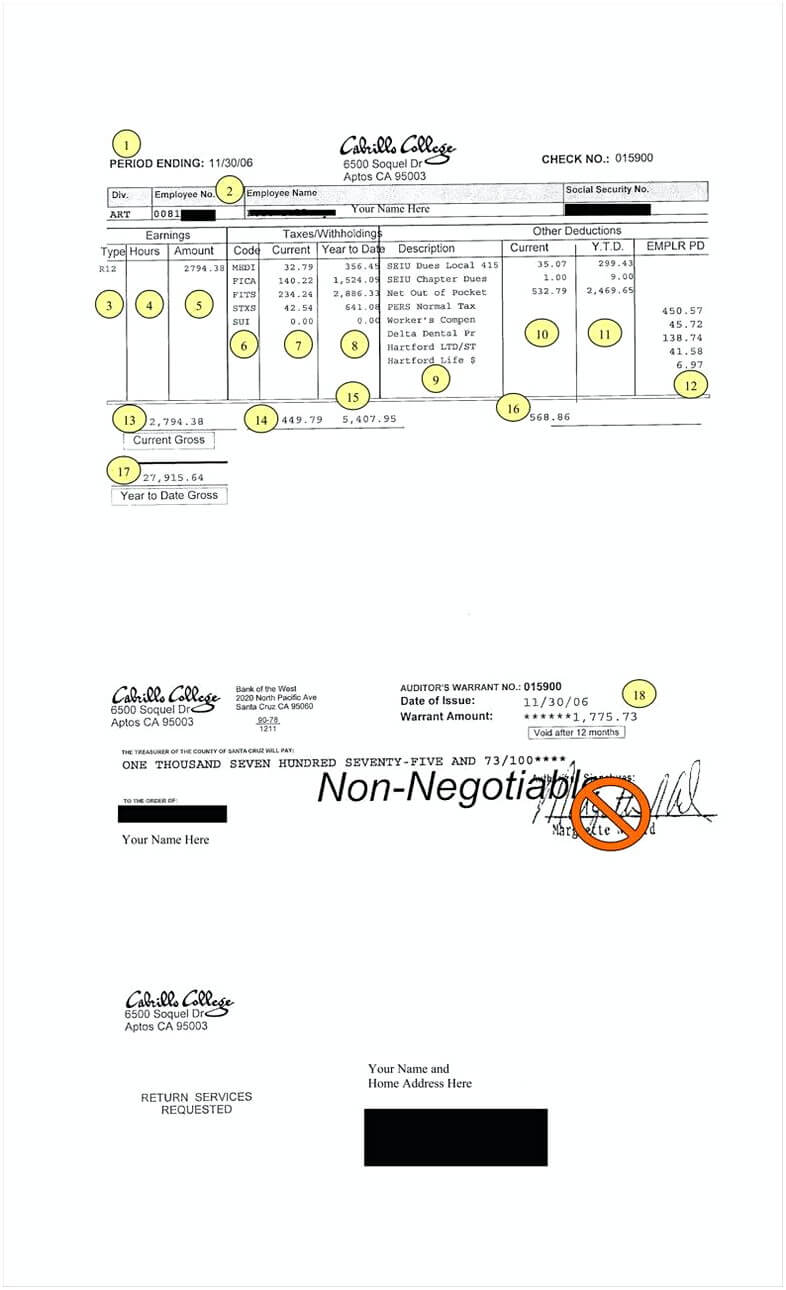

In the pay stub, there are some details should include which this will depend on the circumstances. In the pay stub template, usually the following information will be included:

- Gross Pay – It is a payment before some deductions for the local taxes, state and also federal. Besides, the gross pay hasn’t included the social security as well as the Medicare also the retirement contribution. The gross pay will be included if an employee can make $50,000 a year.

- Federal taxes withheld – This is a personal income tax that will be different for each country and it depends on the income you get per month as well. Usually, it is started at 10% in America.

- State taxes withheld – This is for a person who comes from a state but working in different states. Hence both countries will ask your income tax.

- Local Taxes Withheld – This is the local taxes which might be different in certain areas.

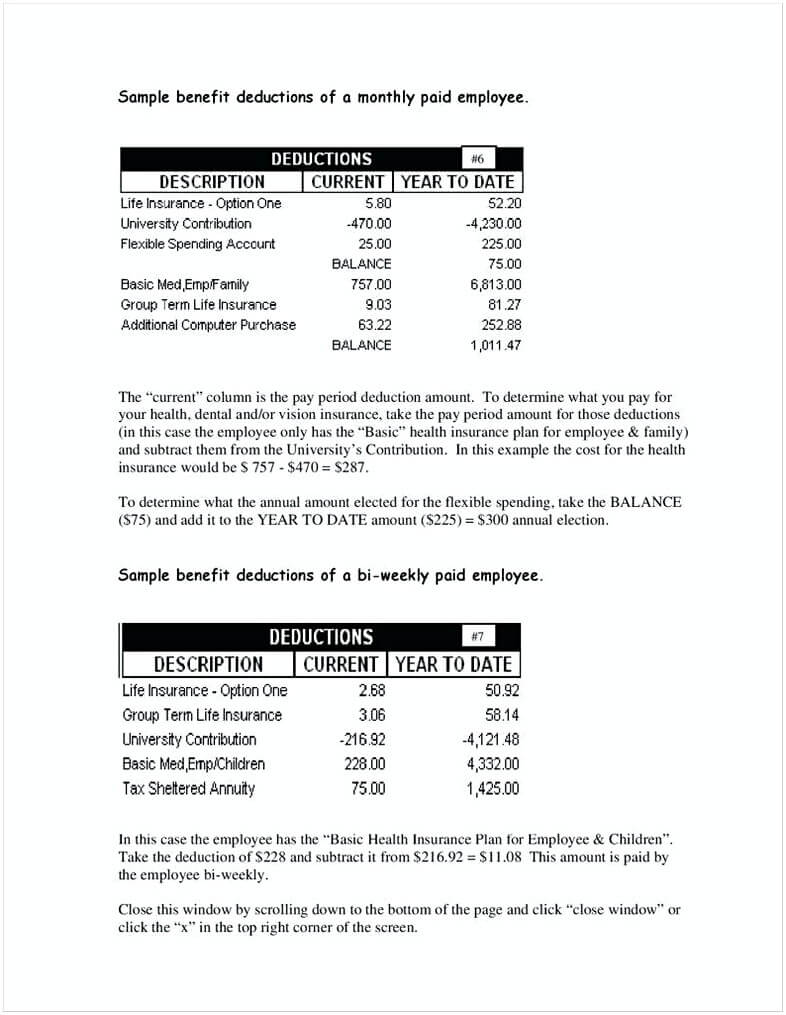

- Benefit Insurance Deduction – This includes the life, dental, health as well as disability which if you are willing to share your income in this section, these will be included in the pay stub.

Besides all of the above information, you will have to notice another detail in your pay stub template including the FICA, Retirement, wage garnishments, and also back pay.

For you who are an employer who needs a pay stub template with an interesting format, we have a bunch of templates you can download for free on this page.